Welcome to Indexed Universal Life

Discover the fundamentals of Indexed Universal Life insurance and its unique benefits.

Indexed Universal Life (IUL) insurance combines lifelong coverage with the potential for cash value growth linked to a market index. This guide will help you understand how IULs work, their advantages, and whether they fit your financial goals.

Mechanics of Indexed Universal Life

How IUL policies function day-to-day

With an IUL, you pay flexible premiums. Part of your payment covers insurance, while the rest builds cash value. This cash value can earn interest based on a chosen market index, but your money is never directly invested in the market.

- Premiums are flexible—adjust as your needs change.

- Cash value grows tax-deferred, linked to an index.

- Policy loans let you access funds without selling assets.

Advantages of Choosing an IUL

Tax-Deferred Growth

Your cash value grows without immediate taxes, allowing more of your money to compound over time for greater long-term benefit.

Flexible Premiums

Adjust your premium payments as your financial situation changes, giving you control and adaptability throughout the policy’s life.

Access to Cash Value

Borrow against your policy’s cash value for major expenses, without triggering taxes or selling investments, offering financial flexibility.

Potential Downsides of an IUL

Understand the risks before you commit

- Caps and participation rates may limit your returns.

- Policy fees and costs can reduce cash value growth.

- Loans and withdrawals may impact your death benefit.

IULs are not risk-free. It’s important to review all policy details and consult a financial professional before making a decision.

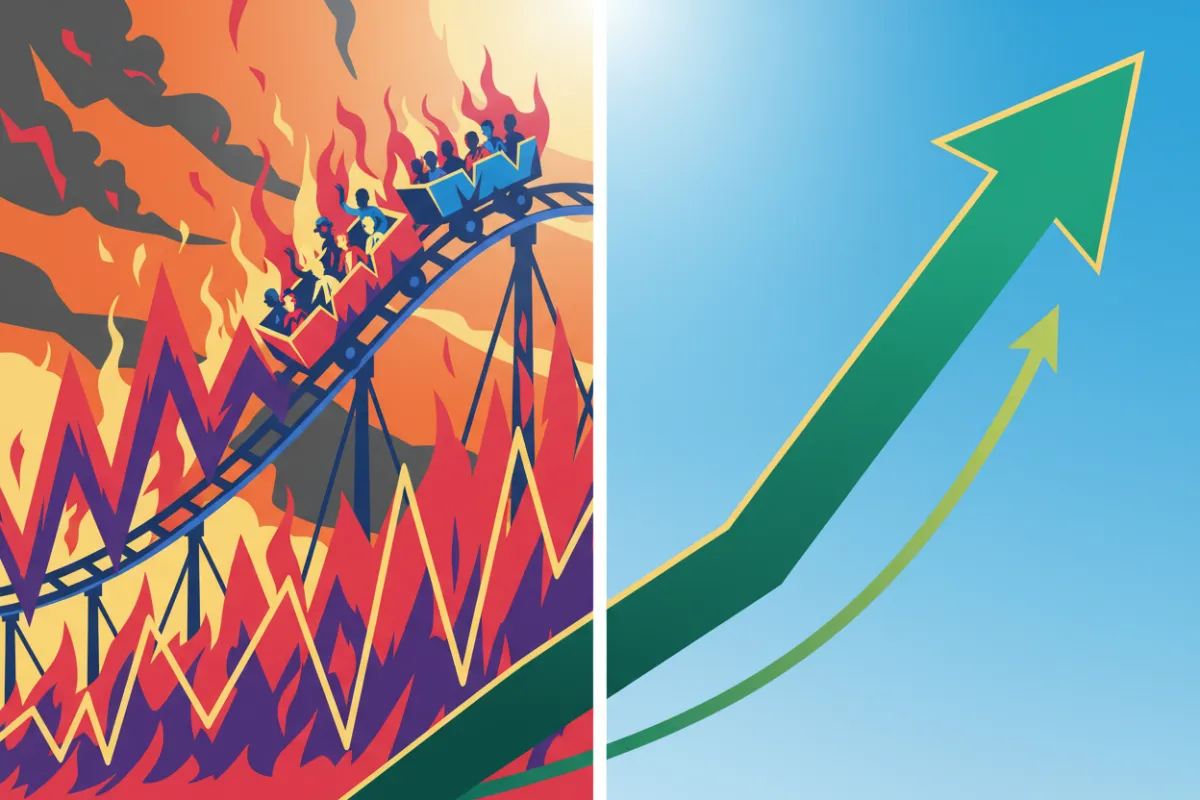

IUL vs. Stock Market Volatility

How IULs compare to direct market investments

Unlike direct stock investments, IULs shield your cash value from market downturns. While you may not capture all market gains, you avoid the risk of losing principal during market declines, offering a more stable growth path.

Who Should Consider an IUL?

Ideal candidates for Indexed Universal Life

Risk-averse investors seeking stable growth.

Individuals needing lifelong insurance coverage.

Those interested in tax-advantaged savings options.

Great for Business Owners with monthly payroll

If you value both protection and growth, and want flexibility in your financial planning, an IUL may be a strong fit for your needs.

Is an IUL Right for You?

Consider your goals and risk tolerance

Indexed Universal Life insurance offers a unique blend of protection and growth. Review your financial objectives, consult with one of our advisors, and decide if an IUL aligns with your long-term strategy.