Understanding Fixed Indexed Annuities

Clear, practical information

Want a straightforward way to save for the future? This page explains fixed indexed annuities in plain language, shows how they can grow over time, and highlights key points to consider when choosing one.

What Is a Fixed Indexed Annuity?

A fixed indexed annuity is an insurance contract that helps your savings grow while protecting your original amount. Your money can increase when a market index goes up, but it will not lose value when the index falls. It is meant to provide steady, long-term growth and income protection.

How Fixed Indexed Annuities Work

Add Money

You put money into the annuity. The insurance company holds and protects it.

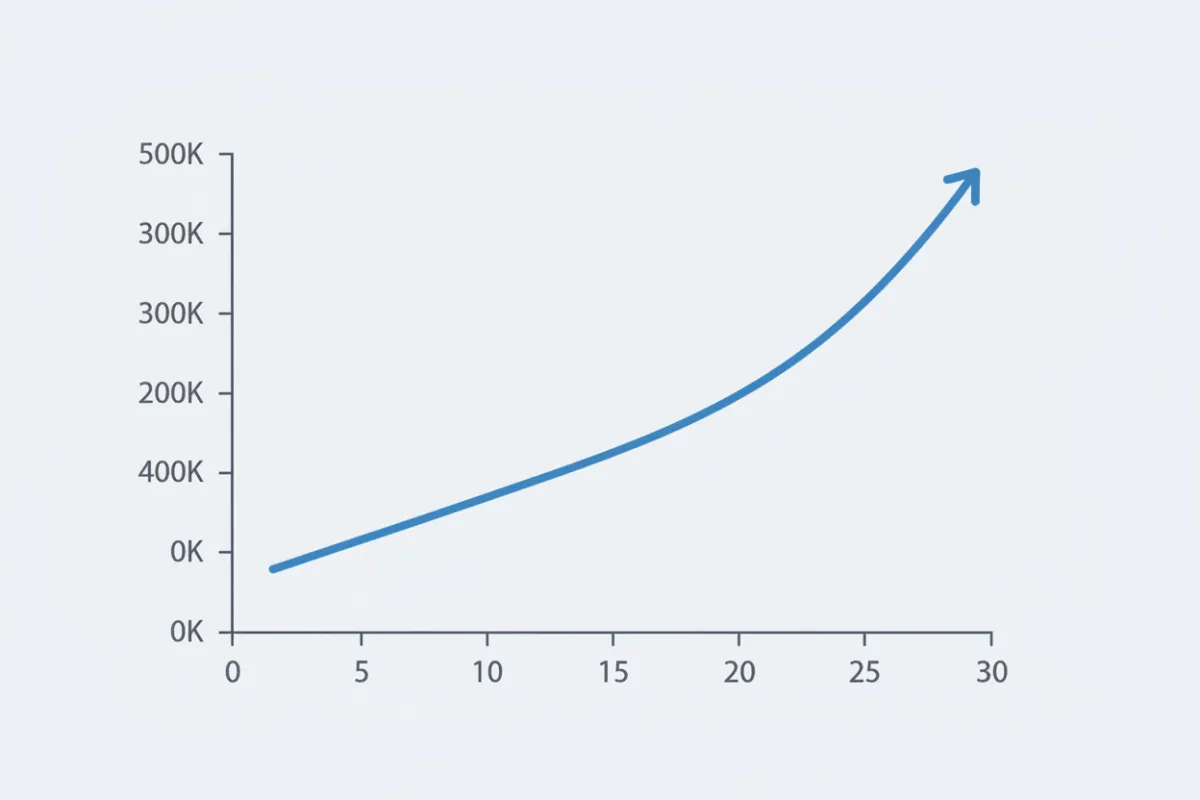

Money Can Grow

Your balance can increase when the market does well. If the market drops, your principal is protected from loss.

Receive Payments

Later you can receive regular payments. Choose the timing and amount that suit you.

Benefits of Fixed Indexed Annuities

Principal Protection

Your original investment is protected from market losses.

Potential Growth

Your funds can grow when the market performs well while your principal remains protected.

Guaranteed Income

You can receive predictable payments later to help cover retirement expenses.

Drawbacks of Fixed Indexed Annuities

Limited Access to Funds

Withdrawals are limited. Early withdrawals may incur penalties or restrictions. Some products do offer free annual withdrawals up to 12% with no penalty.

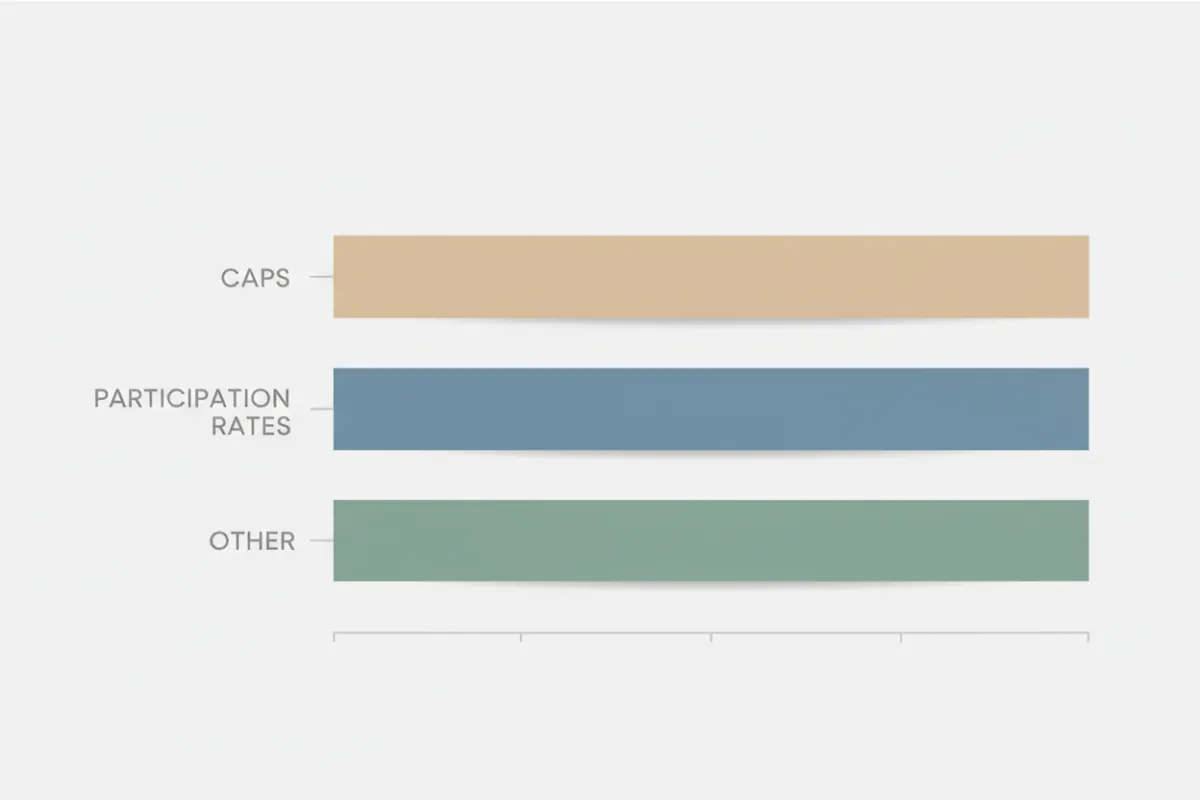

Limited Growth Potential

Some returns may be capped depending on the product. They often trail stock market gains over time. Some products offer returns that can outpace normal market returns.

Possible Fees and Charges

Some products have fees or surrender charges. Ask about all costs before you buy.

Who Is a Good Candidate for a Fixed Indexed Annuity?

Fixed indexed annuities are well-suited for certain types of investors and savers. Here’s who may benefit the most from these unique financial products:

- Risk-averse investors seeking principal protection

- Near-retirees planning for predictable retirement income

- Investors seeking some market-linked growth without direct market risk

- Individuals wanting tax-deferred growth and estate-planning benefits

- Those looking to diversify retirement income sources and reduce volatility

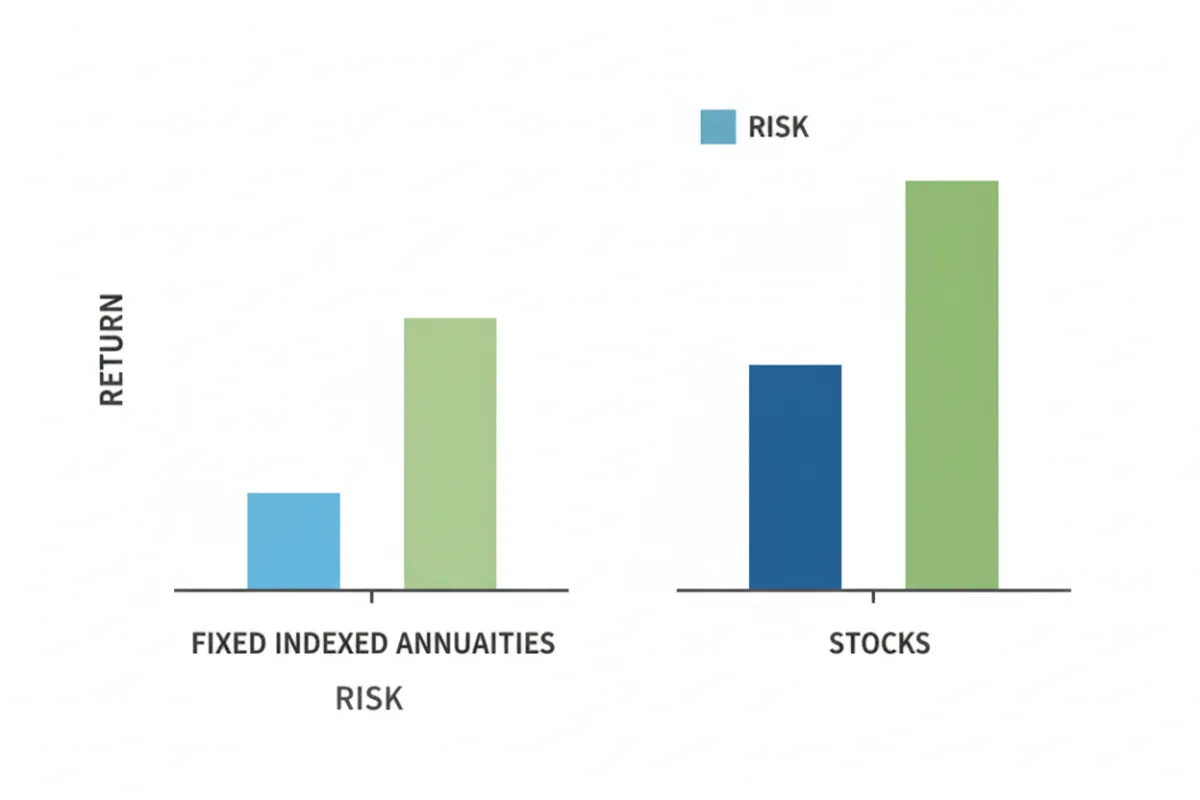

Fixed Indexed Annuities vs Stocks: Risk and Return

Stocks can rise and fall quickly and may lose a lot of value. Fixed indexed annuities are linked to market gains but protect your original investment from market losses, so they reduce large drops while possibly limiting upside.

Final Thoughts: Is a Fixed Indexed Annuity Right for You?

Fixed indexed annuities can protect your savings from market losses and offer steady growth, but they include limits, caps, and withdrawal rules. Read the contract details and talk with a financial professional before deciding.